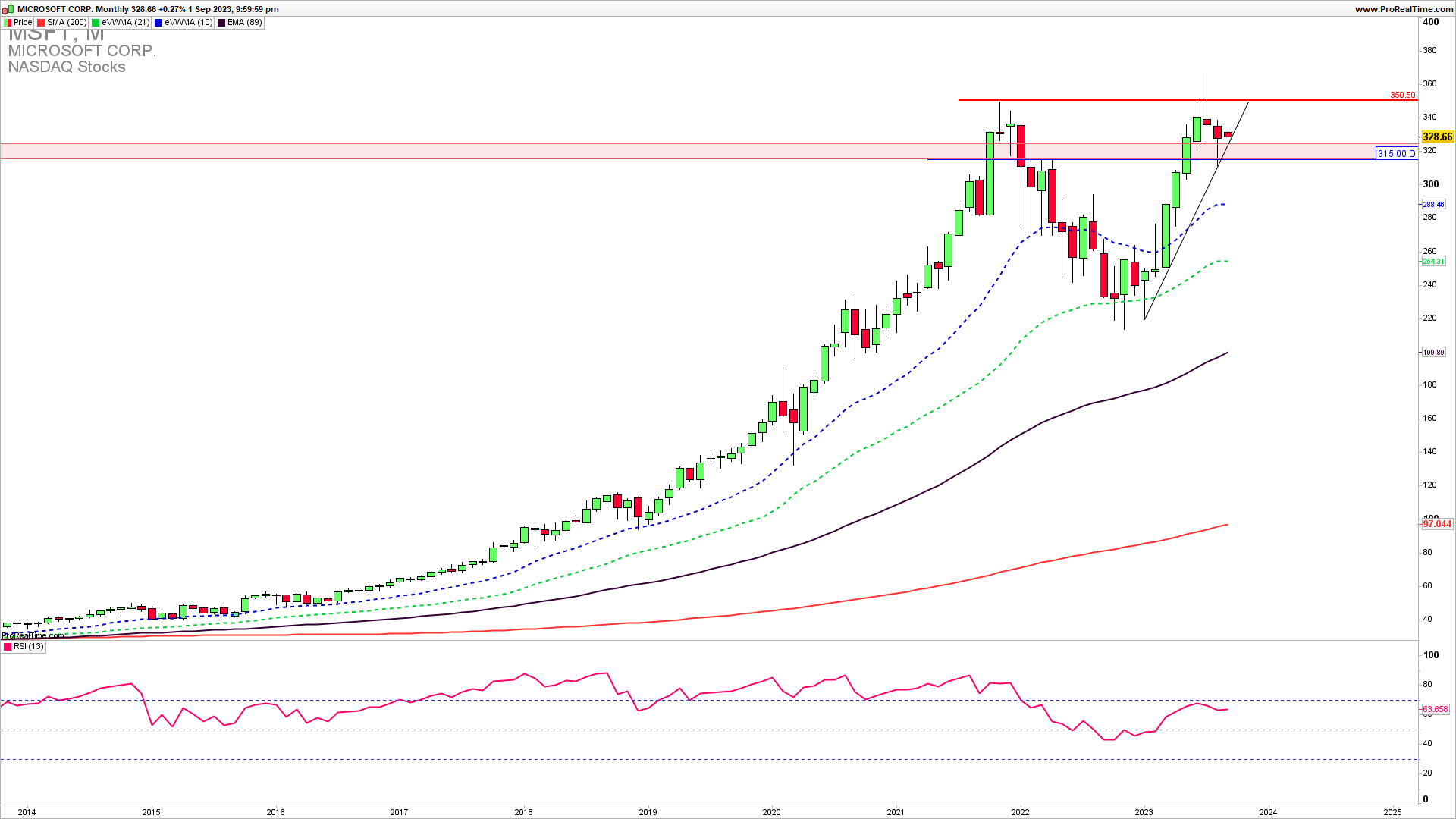

The monthly chart shows a strong uptrend support zone of 315-328 where MSFT extension upside is strongly supported. Bears need to see a break below 315 for the short trades to be triggered and for the put options buying. It is not advisable to trade against this strong long-term uptrend at this point.

SPECIAL SUMMER WEEKEND OFFER TILL 04.09.2023. MENTORING $300

The Weekly MSFT chart reveals a strong uptrend channel support of 318. This is the first strong line of defense for the existing uptrend supported by a rising uptrend line and a horizontal support line. This zone should hold for the extension higher. A break below 318 followed by 315 would lead to a complete downside reversal and a bounce from this ongoing zone will lead to another test of 350. Long trade entries and call options buying are recommended here for swing trading as the risk to reward is good and in favor of buyers.

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

As the famous trader says…

” “Bottoms in the investment world don’t end with four-year lows; they end with 10- or 15-year lows.”JIM ROGERS

How to trade this?

It is a fact that a strong upside support for Q3 is 318 and we have seen a bounce from it so far but we need confirmation. If we get a confirmed bounce from 318 we could see an extension higher to key long-term resistance 350. A break below this level would mean a complete turnaround. Near-term, long-trade entries have a higher probability of success. There is a possibility of long trade entry and short trade here. We can open the long trade here with a bit of risk and stop the loss below 315 and the short trade if we get stopped from the long trade. Also, call option buying is preferred here.