NVIDIA (NVDA) has recently seen a surge in unusual options activity, indicating that major investors are closely watching the stock’s potential movements. Many large trades have leaned bullish, with a significant portion in call options. For instance, on November 11, options transactions tracked by Benzinga showed around $414,714 in calls compared to $192,820 in puts, suggesting a majority bullish sentiment from institutional investors. Options trades have concentrated on strike prices between $130 and $155 for near-term expirations, reflecting anticipated price movements within this range.

Is it hard to trade options? Is it risky? It demands knowledge but options trading is less risky than stock trading as the risk of loss is well limited and known. Stock option trading involves buying and selling options contracts on stocks. Options are financial derivatives that give the trader the right, but not the obligation, to buy (call option) or sell (put option) a stock at a predetermined price (strike price) before a specific expiration date. Here are some key concepts to understand:

-

- Call Options: These give the holder the right to buy a stock at the strike price. Traders typically buy call options when they anticipate that the stock’s price will rise.

- Put Options: These give the holder the right to sell a stock at the strike price. Traders buy put options when they expect the stock’s price to fall.

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The date by which the option must be exercised or it becomes worthless.

- Premium: The price paid to purchase the option. This amount is non-refundable.

- Leverage: Options allow traders to control a larger position with a smaller amount of capital, which can amplify both gains and losses.

- Risk Management: Options can be used to hedge against potential losses in other investments.

- Strategies: There are various strategies in options trading, such as covered calls, straddles, and spreads, each with different risk and reward profiles.

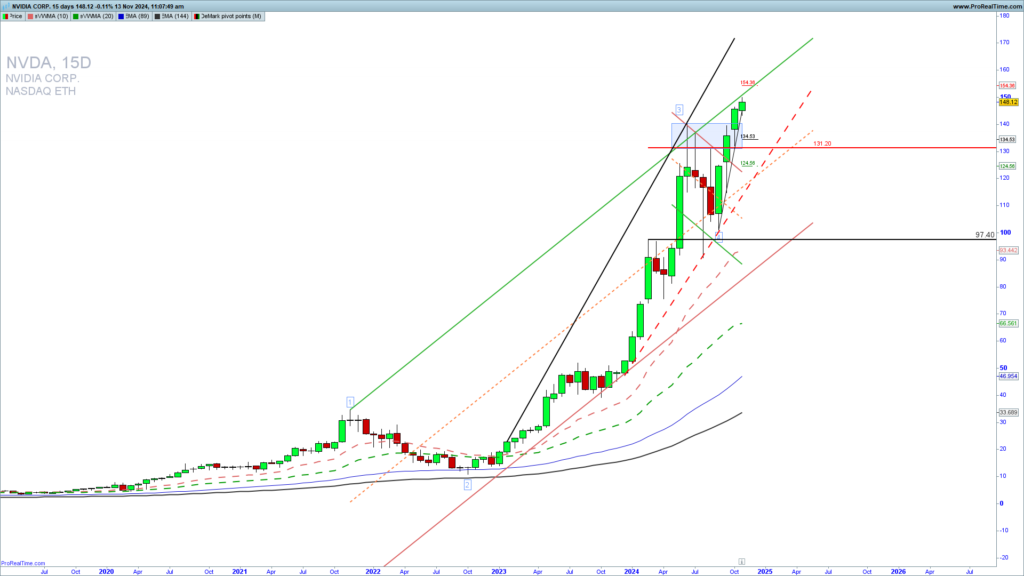

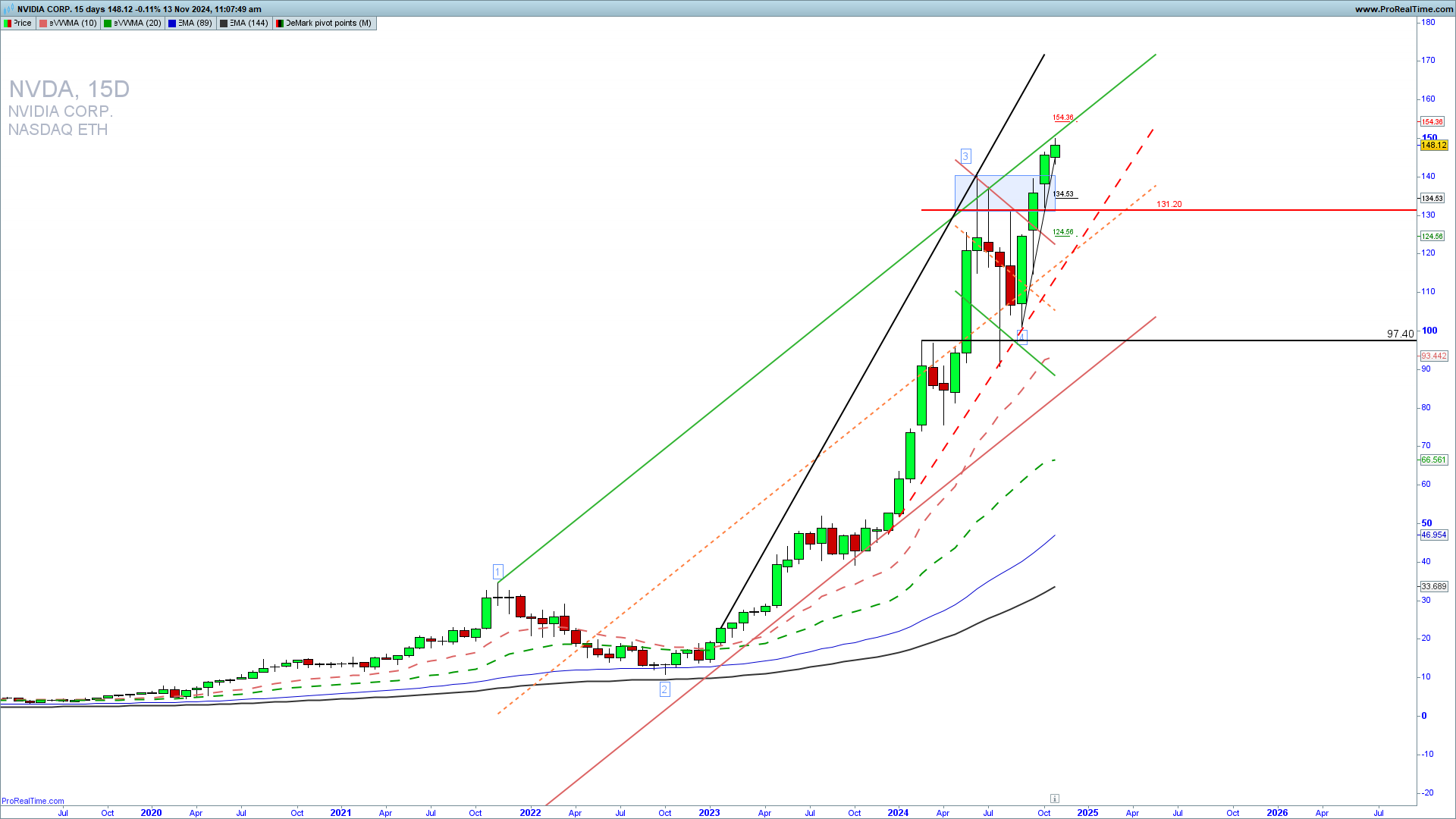

What most traders do not know is that it is far better to use technical analysis in determining the momentum of taking positions in options in specific stocks, or another financial market instrument as you can trade options in a variety of trading instruments, and the principle is the same once you learn it. We are taking NVDA as the real-time trading example in this article but the analysis before building an options trading strategy is the same. You can see how to leverage NVDA options trading in a bullish market.

The 15-day NVDA chart reveals a nice uptrend channel and a kill zone resistance at 150. At this point, the sell positions have a greater probability of success with a little risk if you place stop loss above 150, but we all know that traders are moving stops. Psychologically it is better to trade this with options to limit your loss and hedge the profit you have with buy orders. Overall support for the upside even if it breaks below 140 is 120 and the final long-term support for a bullish trend invalidation is much lower at 150 which means that the uptrend is still very strong but we should see a pullback before an extension and we can use long put option to trade this. Following the price action we need to see a break above 150 for a continuation higher and an extension to 170. So we will choose a long put options trading strategy, buying puts that will benefit from an underlying stock short-term pullback.

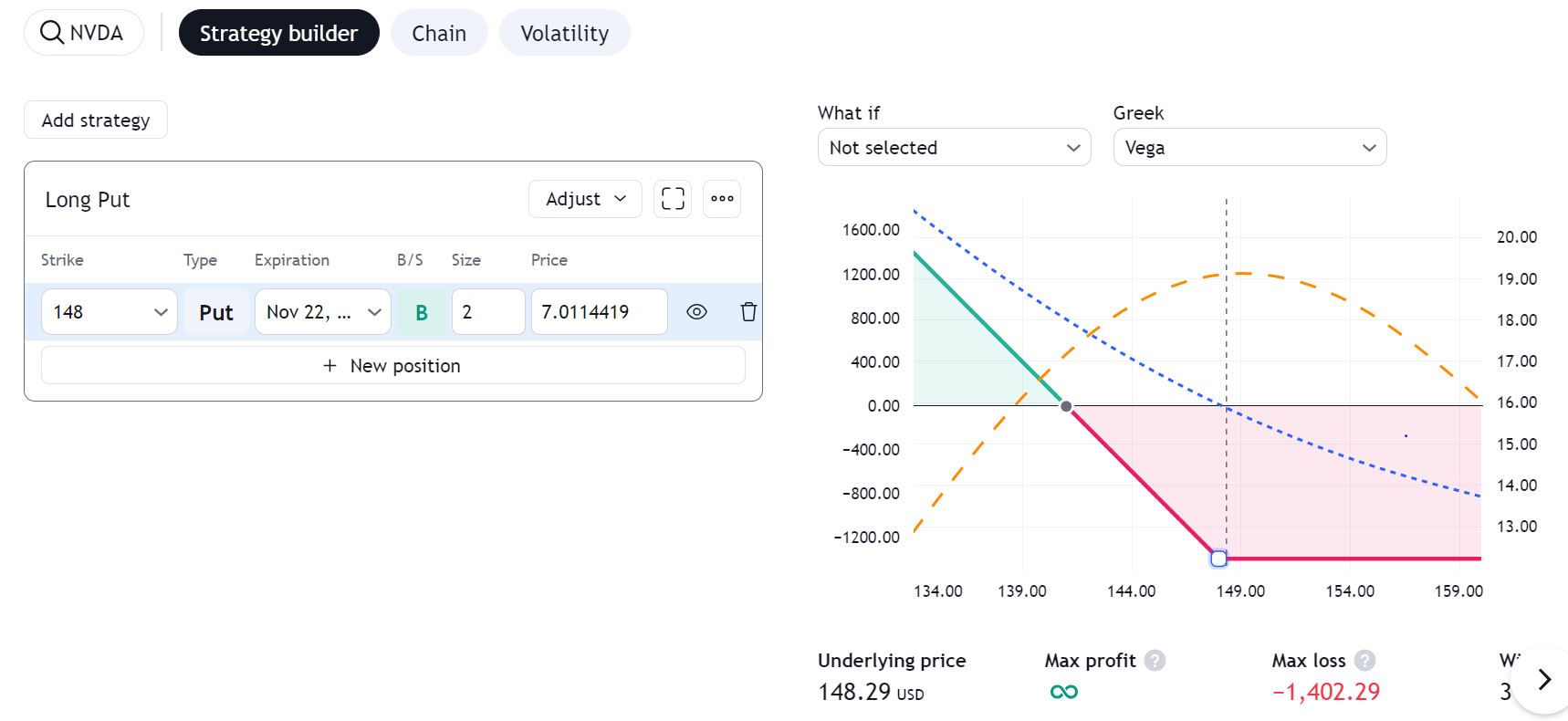

How to trade this with options?

It is a fact that a strong upside resistance for Q4 2024 is 150 and If we get a confirmed break above this level we could see a strong upside continuation for 270 in the fifth long-term upside Elliott Wave. Near-term, short trades as well as put options are in play. Take the long put trade with a strike of 148. 2 units and you will reach breakeven before profit when the NVDA stock price crosses below 148. The maximum loss is around $1400 and the profit potential is $1740 at the range low 134.

For inquiries about account management or copy trading please write to [email protected] or contact me on WhatsApp or Live chat.