Over the past month, AAPL has increased by approximately 0.84%, and in the last year, the stock has risen by around 35.83%. Analysts’ forecasts for Apple’s stock vary widely, with estimates ranging from a high of $300 to a low of $186, reflecting a mix of optimism around new product developments and macroeconomic considerations affecting tech stocks. Apple (AAPL) has recently seen significant developments that could impact investors’ perspectives. In Q3 2024, Apple reported a record revenue of $85.78 billion, up nearly 5% year-over-year, with earnings per share reaching $1.40. This growth was primarily driven by a 14% rise in services revenue and a notable 24% increase in iPad sales, despite a slight decline in iPhone revenue. However, performance in Greater China—a key market for Apple—fell by over 6%, sparking concerns about the company’s ongoing challenges in the region. Is it time for AAPL option trading?

Is it hard to trade options? Is it risky? It demands knowledge but options trading is less risky than stock trading as the risk of loss is well limited and known. Stock option trading involves buying and selling options contracts on stocks. Options are financial derivatives that give the trader the right, but not the obligation, to buy (call option) or sell (put option) a stock at a predetermined price (strike price) before a specific expiration date. Here are some key concepts to understand:

- Call Options: These give the holder the right to buy a stock at the strike price. Traders typically buy call options when they anticipate that the stock’s price will rise.

- Put Options: These give the holder the right to sell a stock at the strike price. Traders buy put options when they expect the stock’s price to fall.

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The date by which the option must be exercised or it becomes worthless.

- Premium: The price paid to purchase the option. This amount is non-refundable.

- Leverage: Options allow traders to control a larger position with a smaller amount of capital, which can amplify both gains and losses.

- Risk Management: Options can be used to hedge against potential losses in other investments.

- Strategies: There are various strategies in options trading, such as covered calls, straddles, and spreads, each with different risk and reward profiles.

What most traders do not know is that it is far better to use technical analysis in determining the momentum of taking positions in options in specific stocks, or another financial market instrument as you can trade options in a variety of trading instruments, and the principle is the same once you learn it. We are taking AAPL as the real-time trading example in this article but the analysis before building a options trading strategy is the same.

The Weekly AAPL chart reveals a nice uptrend support line test and overall a support zone. At this point, the buy positions have a greater probability of success with a little risk if you place stop loss below 210, but we all know that traders are moving stops. Psychologically it is better to trade this with options and limit your loss Overall support for the upside even if it breaks below 225 is 197 and the final long-term support for a bullish trend invalidation is much lower at 130 which means that the uptrend is still very strong and the counter-trend trades are not an option. Following the price action we need to see a break above 235 for a continuation higher and an extension to 280. So we will choose a long call options trading strategy, buying calls which will benefit from underlying stock price extension higher.

How to trade this with options?

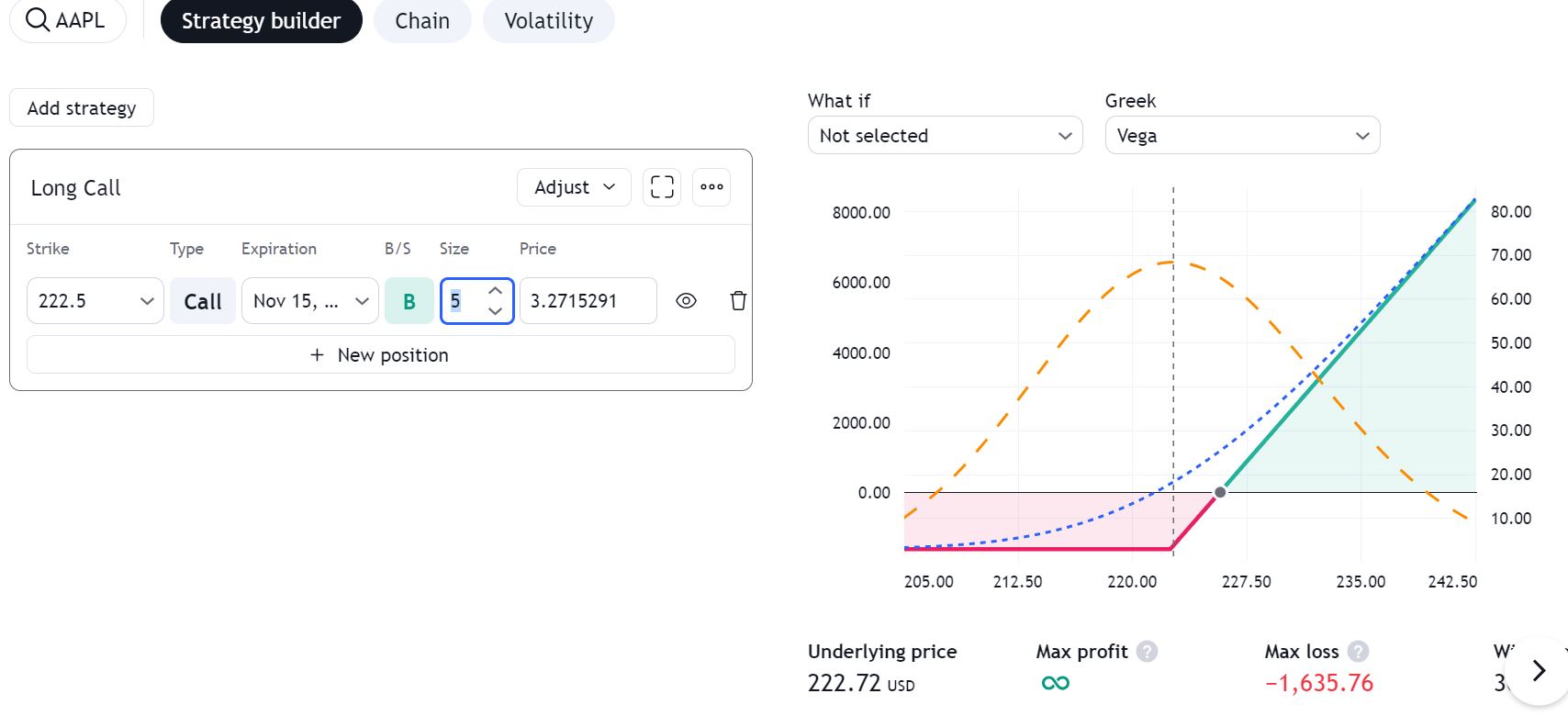

It is a fact that a strong upside resistance for Q4 2024 is 235 and If we get a confirmed break above this level we could see a strong upside continuation for 270 in the fifth long-term upside Elliott Wave. Near-term, long trades as well as call options are in play. Take the long call trade with a strike 222. 5 units and you will reach breakeven before profit when APPL stock price crosses above 236. The maximum loss is around $1700 and the profit potential is unlimited.

For inquiries about account management or copy trading please write to [email protected] or contact me on WhatsApp or Live chat.