Tesla’s Q3 2024 financial results showed mixed performance: while earnings per share slightly exceeded expectations, the company fell short of revenue targets by around $300 million. Tesla attributed part of its profitability to regulatory credit sales and recognizing income from Full Self-Driving (FSD) software updates. Additionally, Tesla has forecasted a record Q4, projecting a year-over-year delivery increase and an 11% boost in quarterly deliveries.

The Foundation Series Cybertrucks, a higher-end initial model, have arrived in large numbers, with deliveries starting this month. Despite initial concerns about high prices, the trucks have been well-received by Canadian reservation holders, with sightings of them on highways and at Tesla stores across the country

TSLA is breaking out above 300 to obtain an extension higher in the long-term third wave to a 600 target and possibly higher. We are seeing a return to a mature bullish phase after the long base and a bullish flag breakout. Only a break below 280 can lead to an invalidation of the immediate extension higher in the most impulsive and the longest third wave. Learn to Trade stocks profitably.

The Weekly TSLA chart reveals a breakout above the strong 290 resistance and a continuation higher. At this point, the buy positions have a greater probability of success. Overall support for the upside even if it breaks below 280 is 210 and the final long-term support for a bullish trend invalidation is much lower at 160 which means that the uptrend is still very strong and the counter-trend trades are not an option. Following the price action we need to see a sustained break above 290 for a continuation higher and an extension to 470.

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

As the famous trader says…

“The elements of good trading are (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.”

Tom Busby

How to trade this?

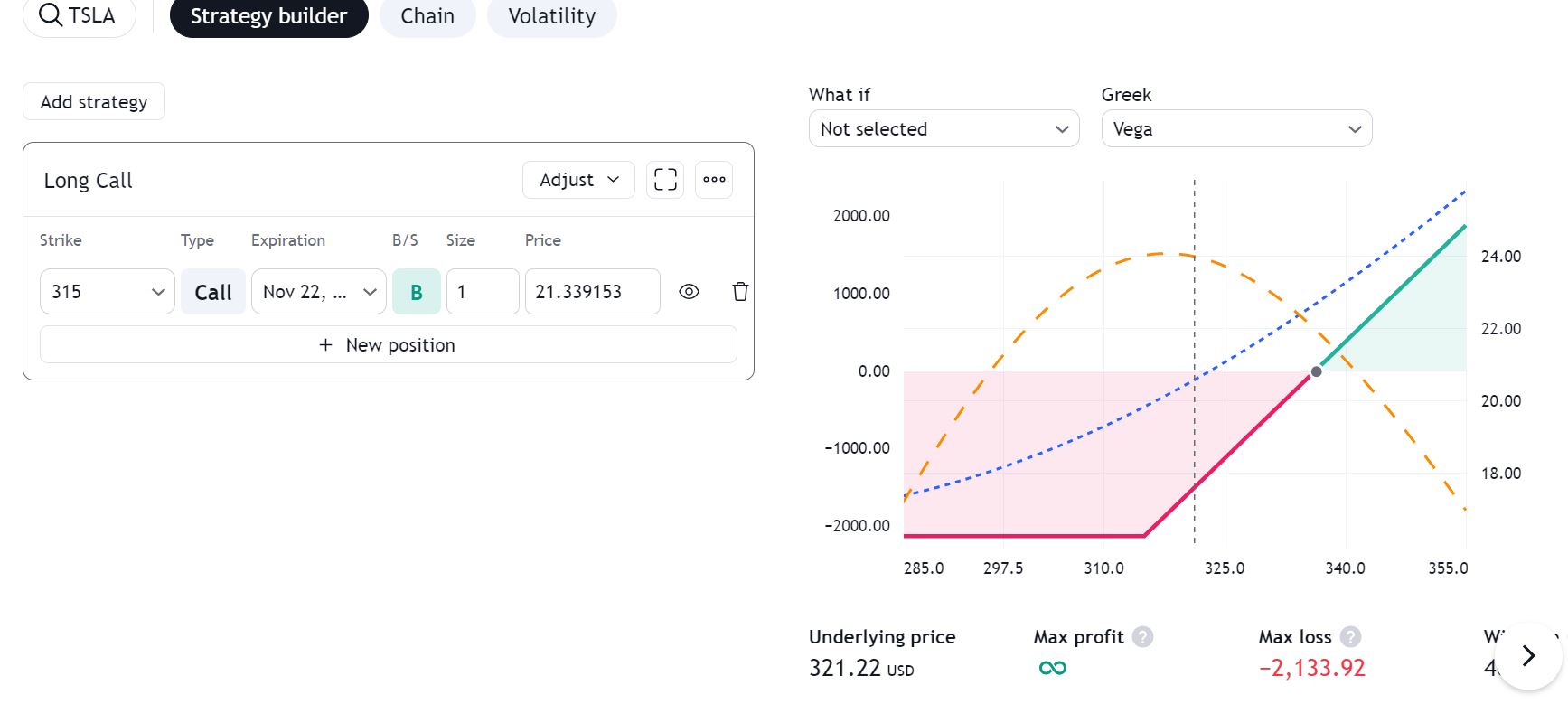

It is a fact that a strong upside resistance for Q4 2024 is 300 and If we get a confirmation of a breakout and a sustained extension above this level we could see a strong upside continuation for 470 in the third long-term upside Elliott Wave. Near-term, long trades as well as call options are in play. Take the long trade here with a stop loss just below 230. You can trade with call options as well like in the example below. For inquiries about account management or copy trading please write to [email protected] or contact me on WhatsApp or Live chat.

OPTIONS TRADING TRAINING 40% OFF