Nvidia is riding a wave of robust demand for its AI and GPU technology, especially following recent announcements and strategic partnerships. The company’s upcoming Blackwell GPUs are already sold out for the next year, underlining strong market confidence in its products and solidifying its role in the AI sector. The anticipated demand is so high that even new orders won’t be fulfilled until late 2025, according to discussions with Morgan Stanley analysts. Nvidia’s current-generation Hopper GPUs are also seeing significant uptake, as they are in high demand by cloud providers like Amazon, Microsoft, and Meta Platforms.

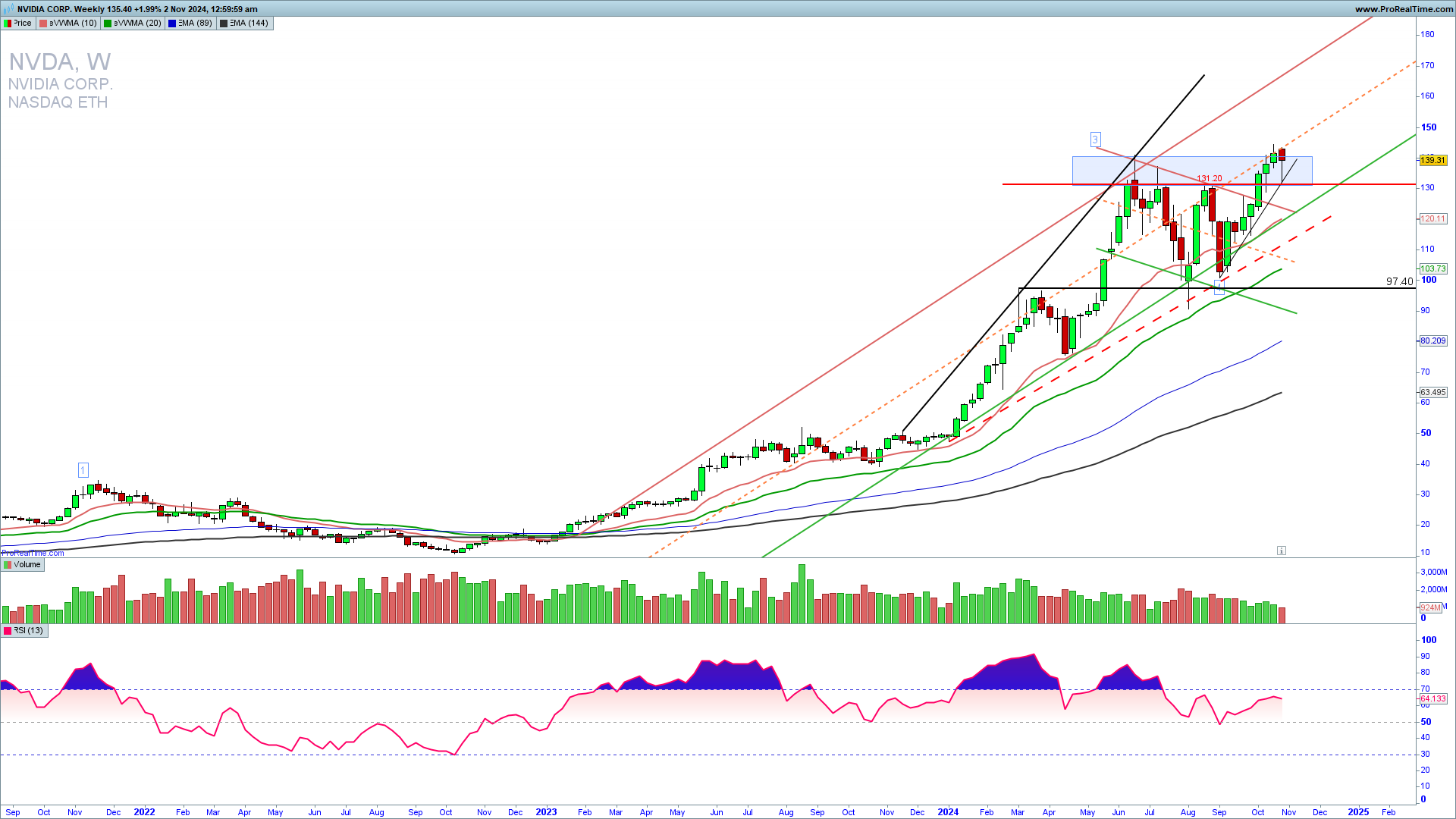

NVDA is breaking out above 131 to obtain an extension higher in the long-term fifth wave to a 200 target and possibly higher. We are seeing a mature bullish phase and it is well within a strong long-term uptrend channel. Only a break below 120 can lead to an invalidation of the immediate extension higher in the fifth wave. Learn to Trade stocks profitably.

The Weekly NVDA chart reveals a breakout above the bullish flag 130 resistance and a continuation higher. At this point, the buy positions have a greater probability of success. Overall support for the upside even if it breaks below 131 is 120 and the final long-term support for a bullish trend invalidation is much lower at 97 which means that the uptrend is still very strong and the counter-trend trades are not an option. Following the price action we need to see a sustained break above 139 for a continuation higher and an extension to 200.

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

As the famous trader says…

“When you really believe that trading is simply a probability game, concepts like right or wrong or win or lose no longer have the same significance.”

Mark Douglas

How to trade this?

It is a fact that a strong upside resistance for Q4 2024 is 140 and If we get a confirmed break above this level we could see a strong upside continuation for 200 in the fifth long-term upside Elliott Wave. Near-term, long trades as well as call options are in play. Take the long trade here with a stop loss just below 120. You can trade with call options as well. For inquiries about account management or copy trading please write to [email protected] or contact me on WhatsApp or Live chat.