SPY remains a highly liquid and diversified investment, often recommended for both novice and seasoned investors seeking exposure to the U.S. equity market.

SPY has gained approximately 17% in 2024, reaching a current price of around $585. Analysts suggest this growth is supported by a generally strong U.S. stock market, with potential resistance levels identified at $591 and support near $571. The ETF has shown controlled volatility, making it a low-risk option for investors. While SPY holds a mix of buy-and-hold signals from technical indicators, many analysts remain cautious about near-term movements, given its high price-to-earnings ratio and recent sell signals from pivot points. Investors are advised to monitor closely for price movements near identified support and resistance levels.

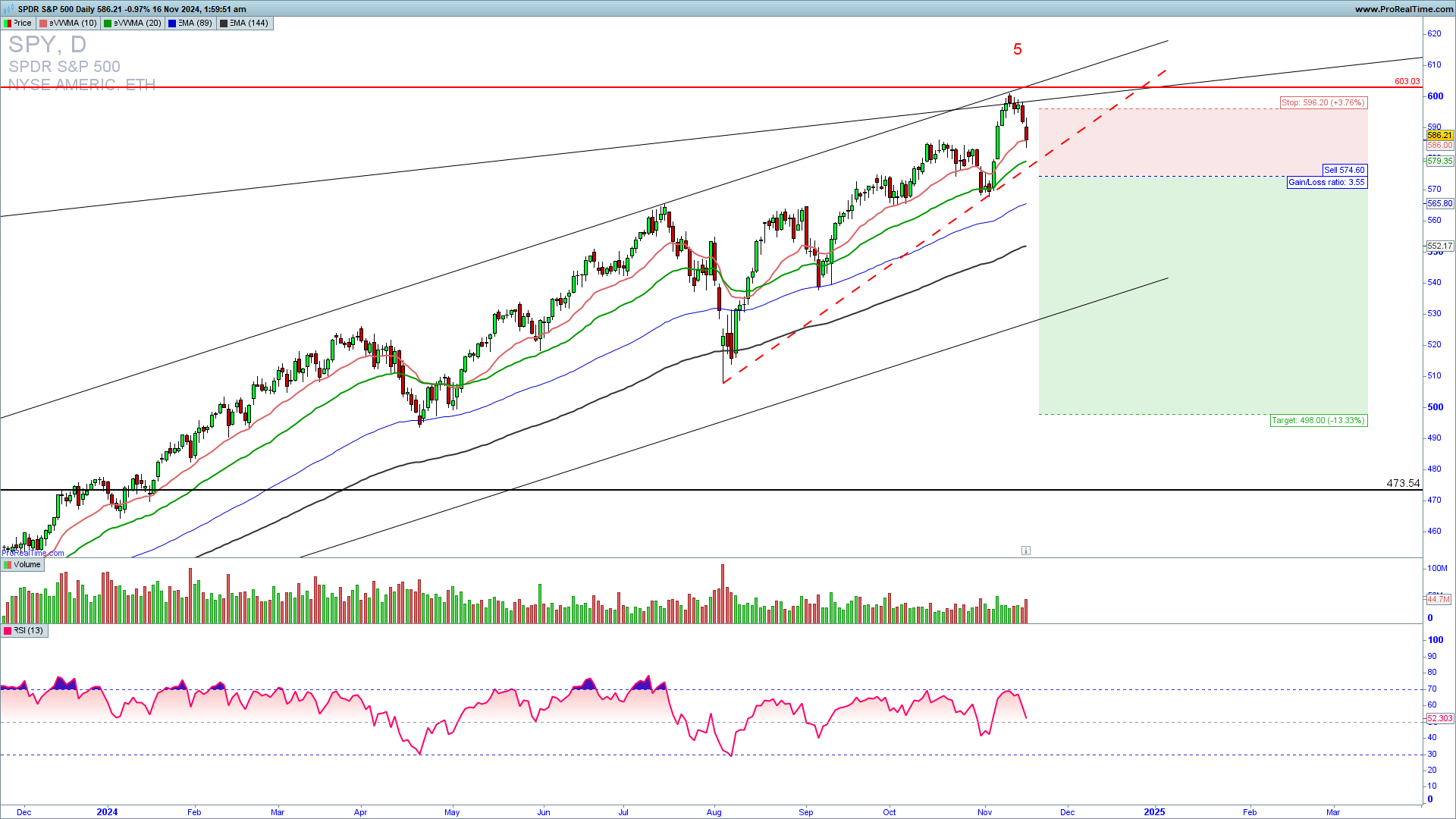

SPY upside extension is now limited with the uptrend channel resistance 603. A break above this level is required for a continuation higher in still third upside wave but it seems that the upside cycle’s third long-term wave has been finished and we should see a pullback lower in a fourth long-term wave before an extension higher in the fifth wave. Learn to Trade stocks profitably.

The Weekly SPY chart reveals a strong rejection from the short-term channel top of 603. At this point, sell positions have a greater probability of success. Overall support for the upside even if it breaks below 568 is 540 and the final long-term support for a bullish trend invalidation is much lower at 470 which means that the uptrend is still very strong but a pullback can happen before a final leg higher. A break below 570 will lead to an acceleration of a pullback

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

As the famous trader says…

“The four most dangerous words in investing are: ‘This time it’s different.’”

Sir John Templeton

How to trade this?

It is a fact that a strong upside resistance for Q4 2024 is 603 and If we get a confirmation of a breakout and a sustained extension above this level we could see still a strong upside continuation for 650 in the third long-term upside Elliott Wave. Near-term, short trades as well as put options are in play. Take the short trade upon a break below the rising wedge support of 575 with a stop loss above 590. You can trade with put options as well. For inquiries about account management or copy trading please write to [email protected] or contact me on WhatsApp or Live chat.

OPTIONS TRADING TRAINING 40% OFF