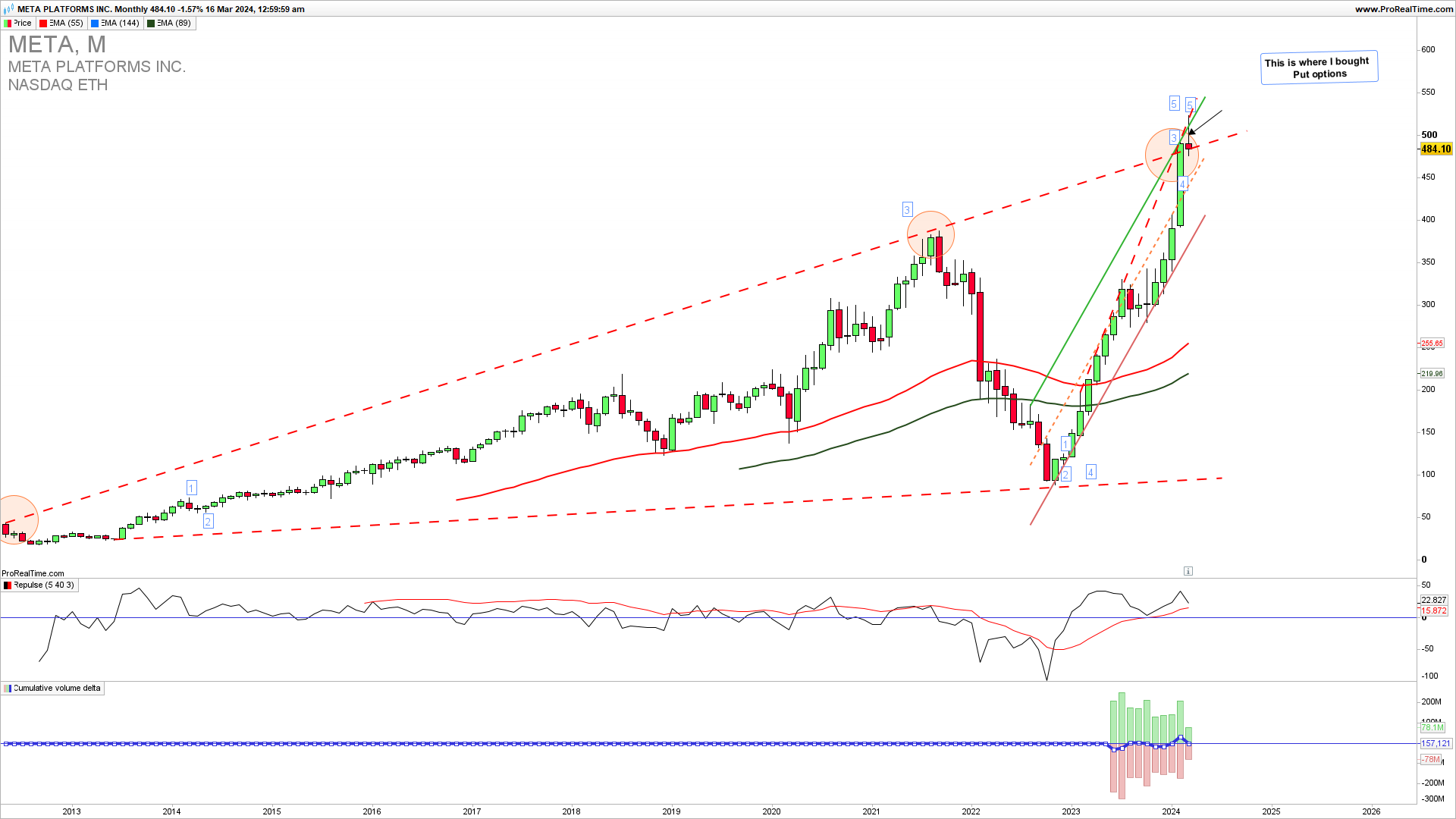

META is rejected from a strong upside extension resistance 520. If we get a breakout above this resistance we could see an extension higher and a test of 600. It will mean that the fifth long-term Elliott Wave is still in process. An extension of the reversal below 470 will open a strong pullback and a test of the most important support 390. Learn to Trade stocks profitably.

How to trade this?

It is a fact that a strong upside resistance for Q3 2024 is 520. If we get a confirmed break here we could see a strong upside continuation and new highs. Near-term, short-trade entries have a higher probability of success. Long trade entries are possible only on a confirmed price-action break above 520. You can try a short trade here with a stop loss above 510 or upon a break below 470. This trade entry has a better Risk to reward and is being confirmed by a rising traded volume. For inquiries about account management please write to [email protected].

The Weekly Meta chart reveals an addition to the previously mentioned, medium-term five waves and a fifth of the fifth wave long-term with an indicated strong downside resistance of 470 which is likely to be broken soon. As the long-term charts imply, at this point look only for the short trade entries or buying put options against the 510 level. We will need to see a big break above 510 to see an extension higher which is now a much lower probability, so we have probably seen a long-term top for META and finished five waves higher.

GET THE CHART OF THE DAY EVERY DAY IN YOUR INBOX

As the famous trader says…

“I have been trading for decades and I am still standing. I have seen a lot of traders come and go. They have a system or a program that works in some specific environments and fails in others. In contrast, my strategy is dynamic and ever-evolving. I constantly learn and change.”Thomas Busby

How to trade this?

It is a fact that a strong upside resistance for Q3 2024 is 520. If we get a confirmed break here we could see a strong upside continuation and new highs. Near-term, short-trade entries have a higher probability of success. Long trade entries are possible only on a confirmed price-action break above 520. You can try a short trade here with a stop loss above 510 or upon a break below 470. This trade entry has a better Risk to reward and is being confirmed by a rising traded volume. For inquiries about account management please write to [email protected].